What’s the Q3 Business Outlook?

Standard & Poor’s 500 companies will start reporting on business conditions in Q2 in July

Investors will hear from money center banks, focusing on how interest rates affect business activity. Then, a wide range of companies will follow, and by the end of July, most S&P 500 companies will have checked in with results.

Going into what is referred to as “earning season,” FactSet research estimates the S&P 500’s (year-over-year) earnings growth rate at 8.8%. That would be the highest year-over-year growth rate since Q1 2022 (9.4%). Remember when there was a lot of talk about a recession? Not so much anymore.

Remember that forecasts and forward-looking statements are based on assumptions, subject to revision without notice, and may not materialize.

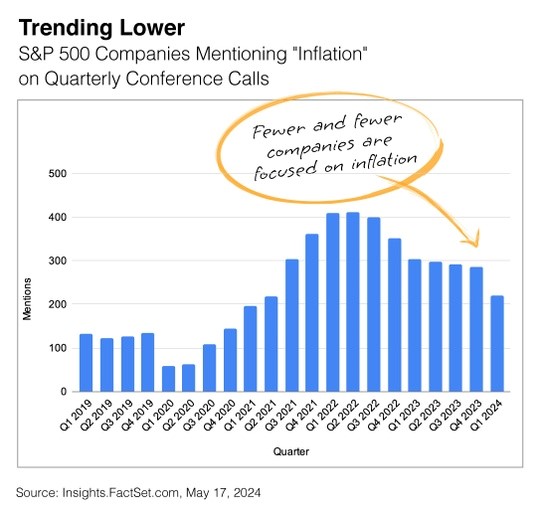

Companies tend to be more connected to the economy’s highs and lows than many people realize. The accompanying chart shows that over 80% of companies discussed inflation in early 2022. However, as inflation has trended lower, fewer companies have mentioned rising prices on conference calls with shareholders.

Over the next few weeks, it’s best to prepare for some volatility. Some investors may read a lot into corporate reports, while others recognize that companies check in with numbers every 90 days, which can be a short time to evaluate performance. So expect some price swings and be surprised if the markets don’t overreact at least once or twice.

Market Insights

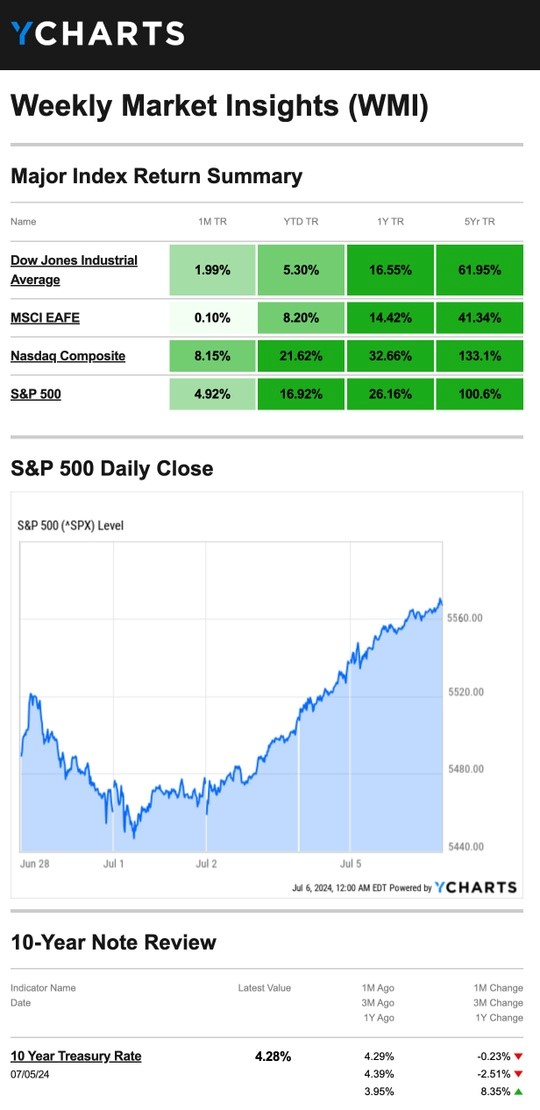

Stocks steadily advanced over the holiday week thanks to strength in mega-cap tech issues and encouraging jobs data.

The Standard & Poor’s 500 Index rose 1.95 percent, while the Nasdaq Composite Index added 3.50 percent. The Dow Jones Industrial Average edged up a modest 0.66 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, rose 2.30 percent for the week through Thursday’s close.

Nasdaq, S&P Extend Runs

ADP’s employment report on Wednesday (July 3) showed private-sector employers added 150,000 jobs in June—slightly slower than May’s pace—adding to investor hopes that a slowing economy may prompt the Fed to adjust short-term rates as early as September. The Nasdaq and the S&P hit their 23rd and 33rd record closes, respectively, for the year.

Friday (July 5) morning’s jobs report from the Labor Department showed 206,000 jobs added last month, which also suggested a strong-but-cooling economy. News of slower job growth, slowing wage growth and a slight uptick in unemployment helped drive down Treasury yields, and stocks finished the short week with a strong rally. The Nasdaq and S&P both closed at all-time highs on Friday.

“Inflation has eased over the past year but remains elevated,” Powell said following the Fed’s June meeting. In other words, “it ain’t over ‘til it’s over.” The Fed wants to see more progress toward the Committee’s 2% inflation objective before considering any changes to monetary policy.

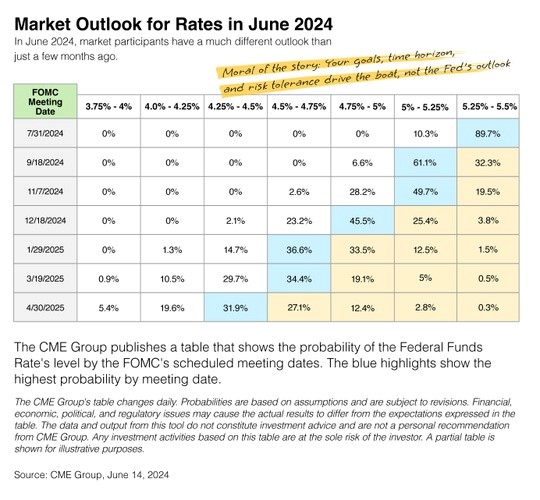

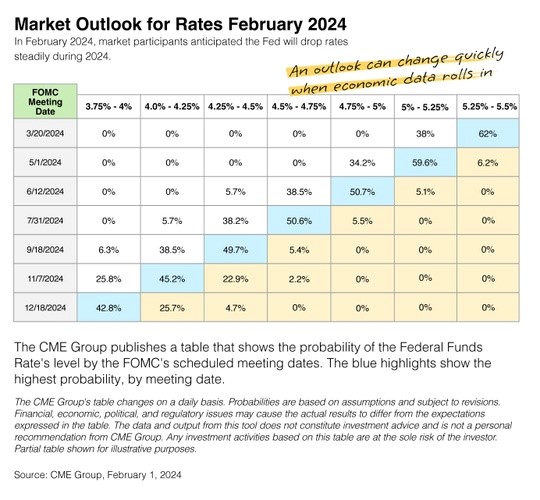

Recall that just a few months ago, the Fed seemed prepared to cut rates three times in 2024. However, an uptick in inflation in Q1 forced them to revise their outlook. At the June meeting, Fed officials anticipate cutting short-term interest rates just once this year.

The Fed’s about-face serves as a good lesson for everyone.

Changes in your goals, time horizon and risk tolerance should drive portfolio adjustments rather than forecasts and best guesses. The economy changes. Markets shift. And the Federal Reserve will adjust its strategy in response to what’s happening.