The Fed’s Bold 0.50% Rate Cut

Wall Street knew a change was coming, but the Fed Chair hid the details until the end

At its September meeting, the Fed cut short-term interest rates by 0.50%, which unsettled some who thought Fed officials would be more cautious with monetary policy this close to an election. However, the Fed, comfortable with its progress on inflation but concerned about the current pace of economic growth, made a bold, decisive statement with the jumbo cut.

Now investors are asking, “What comes next?” To help lend some insight, here are a few events to watch closely in the weeks ahead:

- GDP Report: The advance estimate for Q3 gross domestic product is scheduled for release on Oct. 30. The Fed’s GDP Now estimate shows Q3 GDP at 2.9 percent, but the GDP Now number can fluctuate as more economic data comes in. The official GDP number on Oct. 30 will show whether the Fed is on target for its soft landing.

- Inflation & Jobs: The September Consumer Price Index report is set for release on Oct. 10. Watch for the report to see what’s happening with consumer prices. Various employment data are released weekly, but the next key report is the JOLTS (Job Openings and Labor Turnover Survey), set for release on Oct. 1. The Fed now appears more concerned about the jobs market than inflation, so I’m watching both.

- Fed’s Next Meeting: The Fed’s next scheduled two-day meeting concludes on Nov. 7– the day after the election. The Fed’s December meeting ends on Dec. 18. Speculators see more rate adjustments before the end of 2024, but policymakers will be watching the GDP, jobs, and inflation data to determine what’s next. Following the Fed’s September meeting, Minneapolis Fed President Neel Kashkari said he expects policymakers to dial down the pace of interest rate cuts.

Fed Chair Powell’s keyword following the September meeting was “recalibration.” He suggested that interest rates need to respond to help manage the business cycle. That’s a different message from the Fed Chair, who has spent the better part of two years discussing how to address inflation. From the Fed’s September meeting notes, it’s clear that the Fed has decided to guide short-term interest rates lower.

Source: FederalReserve.gov, 2024

Market Insights

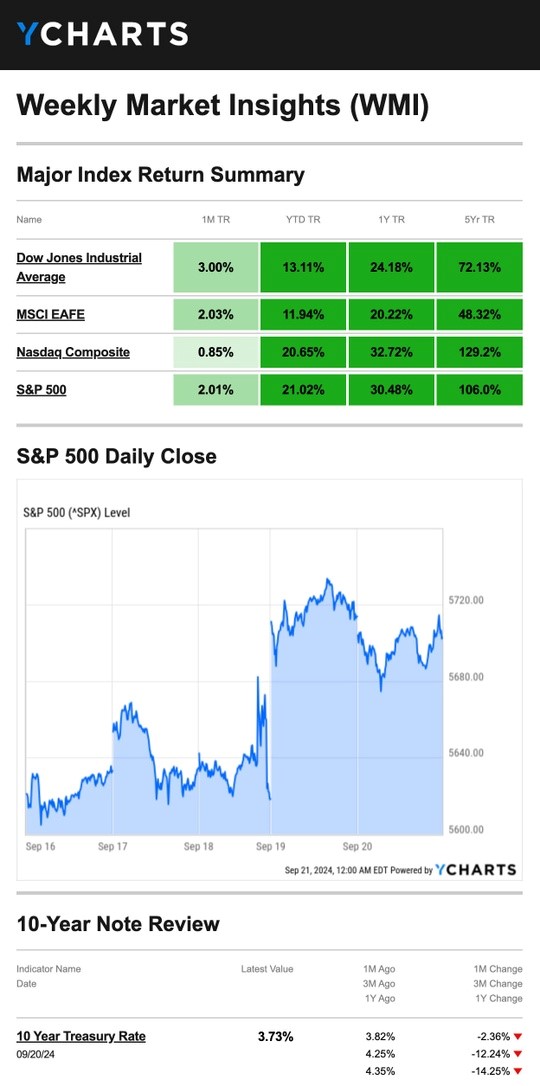

Stocks moved higher last week after the Federal Reserve’s half-point rate cut, bolstered by multiple data points supporting a cooling but still strong economy and decelerating inflation.

The Standard & Poor’s 500 Index gained 1.36 percent, while the Nasdaq Composite rose 1.49 percent. The Dow Jones Industrial Average moved ahead by 1.62 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, inched up 0.42 percent.

Stocks traded in a narrow range for the first half of the week as anxious investors awaited the outcome of the Federal Open Market Committee’s (FOMC) September meeting. Stocks initially rose Wednesday in response to the half-point rate cut and then fell. Some market watchers attributed the decline to concern that the Fed might be concerned about economic growth. But after sleeping on it, stocks rallied Thursday, with the Nasdaq, S&P, and Dow climbing 2.5 percent, 1.7 percent, and 1.3 percent, respectively. The Dow topped 42,000 for the first time, while the S&P crossed the 5,700 mark.

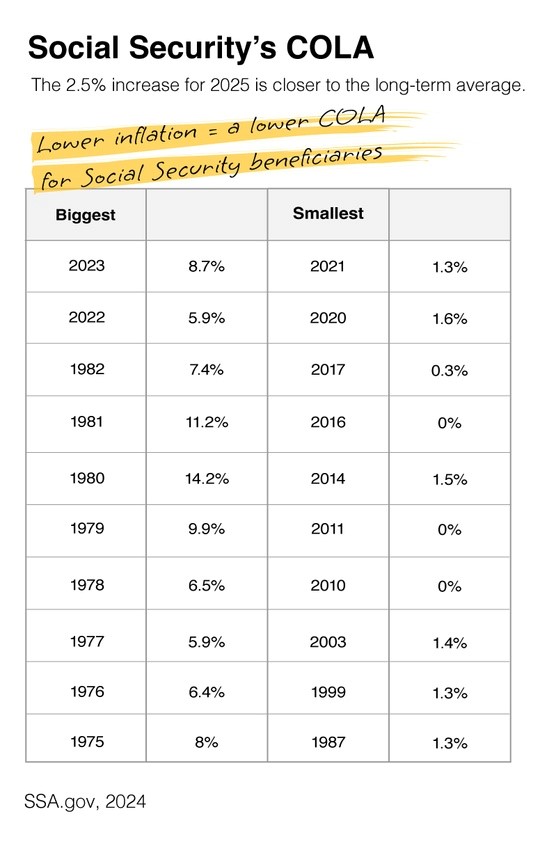

Social Security 2025 COLA: Projected 2.5% Increase

More than 71 million Social Security beneficiaries can expect a 2.5% cost of living adjustment (COLA) increase in 2025, based on the Q3 inflation data so far. In other words, the COLA will raise the average benefit by $48 to $1,968 a month. This is a welcomed increase for some, given inflation during the past year, but it is a drop off from bumps in recent years.

The Social Security Administration is scheduled to announce the official 2025 benefits increase on Oct. 10. But don’t expect the final number to change much, if at all, at this point. The adjustment is based on the average annual increase in the consumer price index (CPI) for urban wage earners and clerical workers (CPI-W) from July through September. Through August, CPI-W rose 2.4% in the past 12 months, compared to a 2.5% increase in CPI.

Almost every retiree (91%) says that Social Security is a source of their retirement income. Almost two-thirds (62%) say it’s a major source. If you think this year’s COLA will make your budget a bit more challenging, please let us know as soon as possible. Sometimes, a slight adjustment can be all it takes to make you feel more comfortable as we head into 2025.

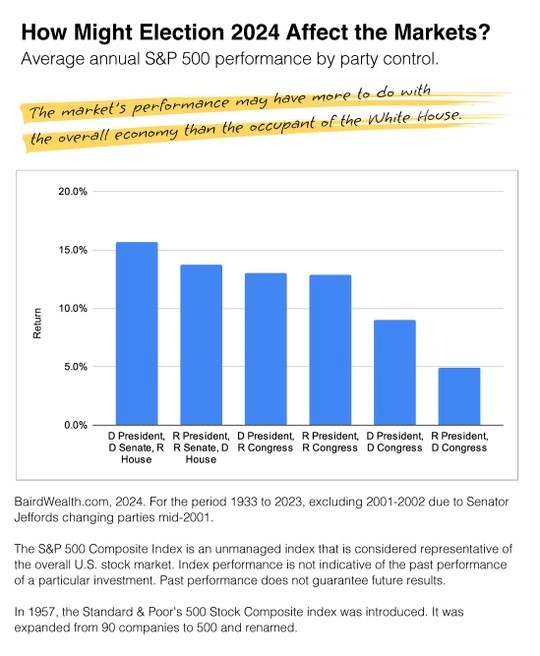

How Might the Election Affect the Markets?

Election years, particularly presidential elections, traditionally come into focus after Labor Day. This is when many American voters become fully engaged with the process. With that in mind, I often get the question: “Politics aside, which way is best for my bottom line?”

Would you believe there’s not much difference? The chart below shows the stock market’s historical performance, whether a D or R appears after the President’s name. As the chart shows, the best average annual returns have come in periods when one party is in the Executive Branch while the other party holds the reins of one or both bodies of Congress. But it’s important to remember that past performance does not guarantee future results.

Why is that? Maybe the system works best when a diverse group of ideas meets face-to-face and comes to a compromise. Or maybe Wall Street has learned how to adapt to the goings on in the District of Columbia.

You may be incredibly passionate about the election’s outcome. It goes beyond the White House, too. There are 34 Senate seats, 435 seats in the House and a wide variety of state and local issues on the ballot this year. Voting is one of the pillars this country was founded upon, so you may be reading up and making careful choices about the nation’s future.

No matter the outcome, keep focused on your investing goals as the election approaches and try to avoid overreacting to short-term market volatility.