Market Update: Warren Buffet Says, “Don’t Watch.”

Stocks Struggle for Direction

Have you ever heard the expression, “If you love sausages, never watch how they’re made?” The same is true of stock prices. Warren Buffett once said, “I would tell [investors], don’t watch the market closely.” In recent weeks, oil prices have rallied higher and the Fed indicated higher interest rates may be here for a while. And there’s a headline risk that lawmakers may struggle to get a budget passed, which may lead to a short-term government shutdown. If you listen to market pundits, it sounds like it’s going from bad to worse.

But August is over, September is coming to a close and next up is October – a month that has had its share of volatile moments over the years. It’s a seasonally weak period for stock prices, and that’s important to remember as stock prices churn a bit.

Market Insights

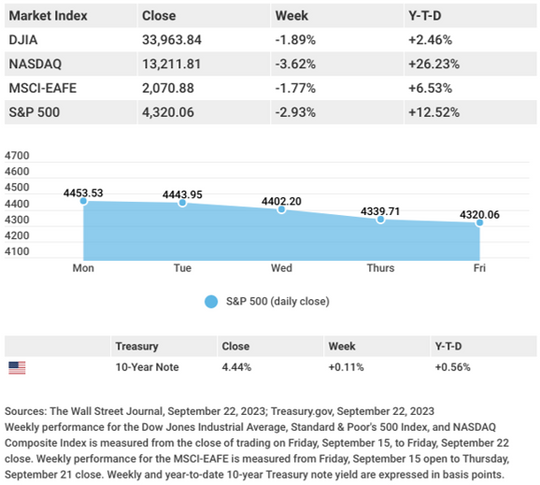

Rising bond yields and fears of a government shutdown hammered stocks last week, with technology shares bearing the brunt of the retreat. The Dow Jones Industrial Average lost 1.89%, while the Standard & Poor’s 500 dropped 2.93%. The Nasdaq Composite index tumbled 3.62% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, fell 1.77%.

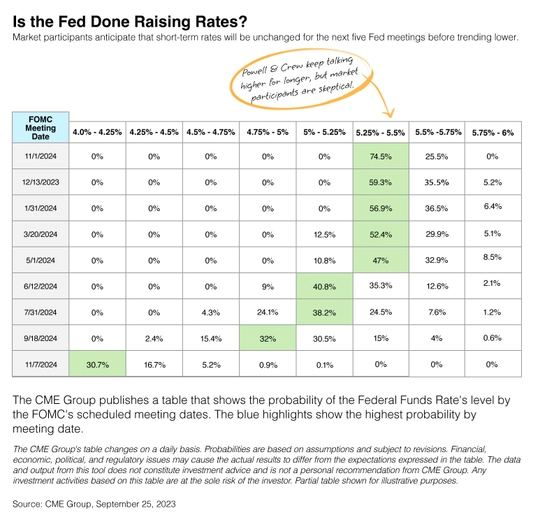

Investor sentiment took a decidedly negative turn last week when investors were caught off-guard by the Fed signaling another potential rate hike this year, upending hopes that the Fed might finish its current rate-hike cycle. Stocks declined sharply following the Federal Open Market Committee (FOMC) announcement and continued to fall the following day as bond yields spiked. The 10-year Treasury yield hit 4.48% on Thursday, touching its highest point in more than 15 years.

Stocks also reacted to news that the House of Representatives went into recess on Thursday, increasing the prospect of a government shutdown. The sell-off cooled on Friday, adding only incrementally to the week’s accumulated losses.

Source: CNBC, September 21, 2023

Fed Signals Rate Hike

As expected, the Fed held interest rates steady but surprised many investors by signaling another rate hike before year-end and suggesting that rates may need to remain high through 2024. In his post-announcement press conference, Fed Chair Powell remarked the inflation battle would continue, and upcoming economic data would inform the FOMC’s future rate hike decision. In their economic projections, 12 of 19 Fed officials expect to raise rates once more this year. (The FOMC meets again on October 31-November 1, and in December.) The Fed also lowered their unemployment projection from their June estimate and revised their projection for annual core inflation to 3.7% in the fourth quarter, down from June’s 3.9% forecast.

Source: The Wall Street Journal, September 23, 2023