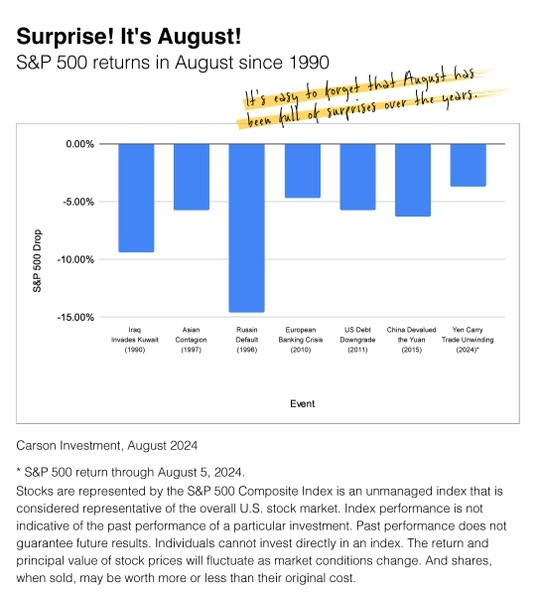

August: A Month Full of Surprises for the Market

August is the month when many families take their final summer vacation. It’s also the month when back-to-school preparations start and football season comes into focus. But August has a more unsettling side for investors. It’s a month known for surprises—and not in a good way!

As you can see from the accompanying chart, investors have managed through seven exogenous shocks in August in the past 34 years. Some have been worse than others, but you get the idea. August is a month of surprises.

The good news is that in 2024, stock prices appear to have shaken off the surprise news regarding the Yen carry trade that rattled markets. Investors are focusing on the economy, inflation and the Fed’s next move with interest rates, which could come as early as next month.

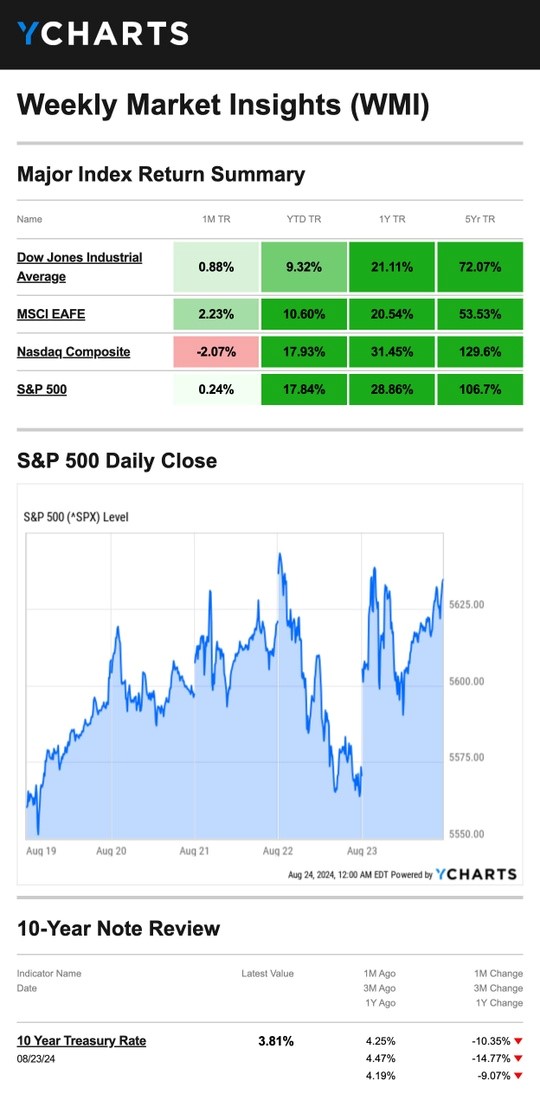

Market Insights

Stocks notched a solid gain as dovish comments from Federal Reserve officials boosted the market’s recovery from early August lows. The Standard & Poor’s 500 Index rose 1.45 percent, while the Nasdaq Composite added 1.40 percent. The Dow Jones Industrial Average picked up 1.27 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, gained 2.98 percent.

Stocks started the week strong, rallying after Wall Street welcomed dovish comments from Minneapolis Fed President Neel Kashkari. The S&P 500 and Nasdaq each posted gains on Monday–the 8th consecutive winning session. The Dow rose for the 5th session in a row.

From there, markets traded in a narrow band until Wednesday afternoon when minutes released from the July 30-31 FOMC Meeting revealed more dovish comments. On Thursday, stocks dipped ahead of Fed Chair Jerome Powell’s annual Jackson Hole, Wyoming, speech (see more below). Well-received comments from Powell on Friday boosted markets, with all three averages closing higher.

The Time Has Come for Policy to Adjust

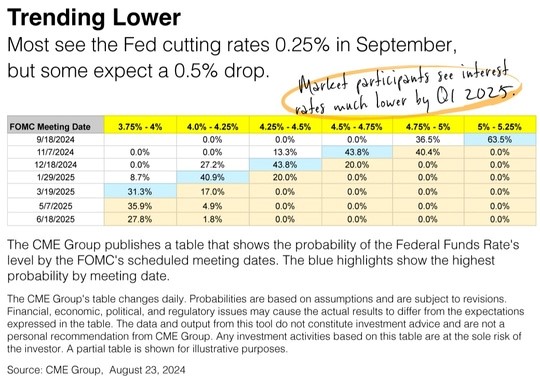

Now the only question is, “How much will short-term interest rates drop in September?”

At his annual speech to global central bankers in Jackson Hole, Wyoming, Fed Chair Powell laid out a strategy to cut short-term interest rates, but he stopped short of saying “when” or “how much.”

So, the financial markets helped him fill in the blanks to both questions. The table below suggests that the first cut will be in September. It shows that 64% of market watchers anticipate 0.25 percent. The others agree on September but see a deeper 0.5% cut. Remember, the current Fed Fund target is 5.25% to 5.5%. As the table shows, the CME Group no longer considers the 5.25% to 5.5% range possible after September.

“The time has come for policy to adjust,” Powell said in his keynote address. “The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook, and the balance of risks.” Powell’s hat-tip to incoming data caught some by surprise.

The Bureau of Labor Statistics said the economy created 818,000 fewer jobs during the 12-month period ending March 2024. The BLS has been known to make adjustments to jobs data from time to time, but this was the largest change since 2009. As recently as July, the Fed indicated it’s “data dependent,” so the accuracy of the BLS report is a concern.

Interest rates are poised to trend lower before the election, which is a surprise to some who expected the Fed might sit tight until after Nov. 5. As everyone who took economics may recall, bond prices tend to increase when interest rates decrease. So change in the wind!

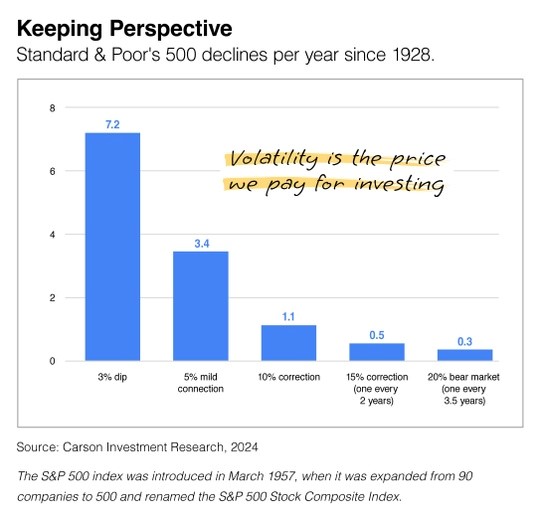

How to Manage Market Volatility

The trader’s adage goes, “The stock market takes the stairs up and the elevator down.” The saying helps illustrate the speed at which stock prices can move. Here’s how the recent stock market drop happened.

First, we saw disappointing Q2 corporate reports from several high-profile technology names, along with discouraging news from Federal Chair Powell about short-term interest rates. Following this was confusion from the Japanese market and other international issues mixed with uncertainty regarding the upcoming election. And just like that, stock prices pulled back. However, it may be helpful to remember that volatility is part of the investing process. The following table shows that more than seven times a year, investors should expect pullbacks of 3 percent, and at least once a year (since 1928), investors should be prepared for a 10 percent correction. When viewed from a historical perspective, recent market activity isn’t as abnormal as one might think.

I know that it’s uncomfortable when stock prices pull back or slip into correction territory. Financial media can make the day’s events seem overwhelming, which can cause some investors to lose focus on their overall strategy. If you’re starting to feel like “it’s different this time,” please contact an Adams Brown Wealth Consultant.