2025’s Financial Landscape

As we transition into 2025, investors are navigating a landscape shaped by pivotal fiscal policies, evolving monetary strategies, geopolitical uncertainty and the growing influence of digital assets like Bitcoin. This period of change offers both challenges and opportunities, and staying informed is key to making strategic decisions.

Fiscal Policy

The 2017 Tax Cuts and Jobs Act brought significant tax reforms, many of which are set to expire in 2025. However, the election outcome may influence whether some provisions are extended. Investors should remain vigilant, especially regarding estate strategies, which could see updates as the year progresses.

Among proposed tax reforms, reducing the corporate tax rate seems most likely to gain traction. While its passage through Congress is uncertain, businesses and investors should evaluate how such changes might impact their tax planning and long-term strategies. For instance, companies might consider adjusting capital expenditure plans to take advantage of current provisions before potential reforms are enacted.

Monetary Policy

When discussing monetary policy, all eyes shift to the Fed and what it will do with interest rates. At its December meeting, the Fed cut rates but indicated it may make fewer adjustments in 2025. The anticipated changes under the new administration will most likely leave the current trajectory of economic and monetary policy unchanged over the next few years.

Geopolitical Factors

The global landscape remains fraught with uncertainty due to continuing conflicts, governance transitions and economic debates. These factors keep the global stage unpredictable, underscoring the importance of vigilance in considering how they might impact both international and domestic investments.

Bitcoin

In December 2024, Bitcoin catapulted above $100,000 for the first time, a milestone hailed even by skeptics as a coming-of-age for digital assets. There’s little doubt that cryptocurrency is here to stay and will continue to evolve, given its ability to facilitate decentralized transactions in an increasingly digital world. However, while its potential for future widespread adoption presents exciting opportunities, it’s important to be mindful of its inherent volatility and the risks it carries.

As these factors continue to take shape, we’re here to help. Please don’t hesitate to contact us if you have any questions or just want to chat about what else 2025 may hold.

Sources: Goldmansachs.com, 2024 and Reuters.com, Dec. 5, 2024

Market Insights

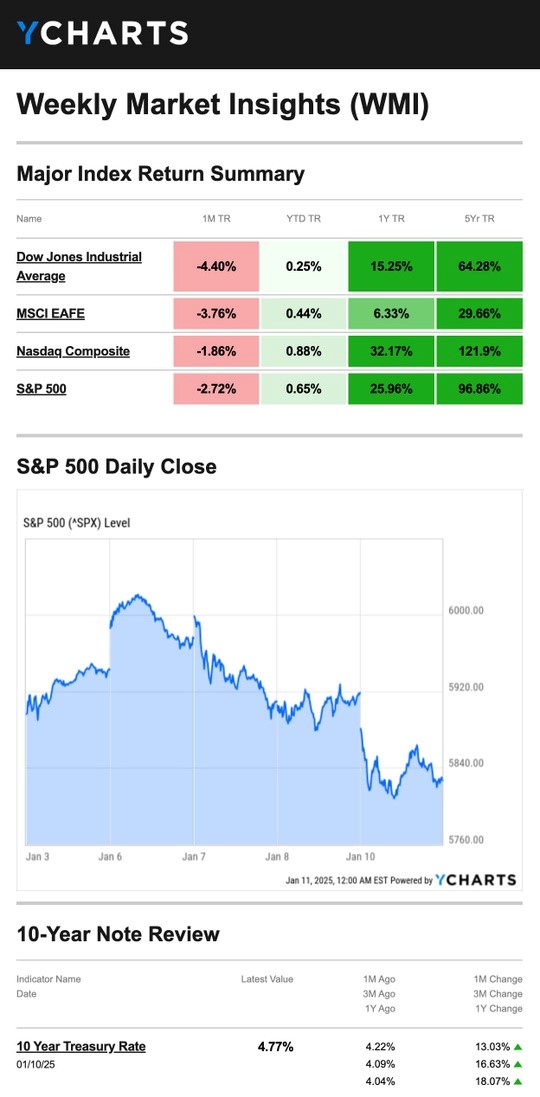

Stocks fell for the second consecutive week as a round of fresh economic data stoked inflationary fears among investors.

The Standard & Poor’s 500 Index declined 1.94 percent, while the Nasdaq Composite Index dropped 2.34 percent. The Dow Jones Industrial Average lost 1.86 percent. The MSCI EAFE Index, which tracks developed overseas stock markets, slipped 0.49 percent.

Inflation Stymies Markets

Stocks rallied broadly to start the week, but two economic reports on Tuesday—job openings and the prices-paid index among service companies—raised fresh inflation concerns. Higher Treasury yields also put pressure on stocks. Stocks flattened out on Wednesday. Investors reacted to news that most Federal Open Market Committee members agreed inflation risks had increased, per minutes from the Fed’s December meeting. U.S. stock markets were closed Thursday in observance of President Jimmy Carter’s funeral. On Friday, a warmer-than-expected December jobs report caused investors to question whether the Fed will adjust rates in 2025. News that consumer sentiment ticked down also pushed stocks lower.

Source: YCharts.com, Jan. 11, 2025. Weekly performance is measured from Friday, Jan. 3 to Friday, Jan. 10.

TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

What is the Social Security Fairness Act?

You may have heard about the recently signed Social Security Fairness Act and wondered what it was and how it might affect you.

The Social Security Fairness Act eliminates two longstanding provisions for Social Security: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

These rules previously reduced Social Security benefits for retirees who receive pension income from non-covered employment.

This legislation is projected to result in an average monthly increase of $360 for eligible public sector workers, as well as their spouses and survivors. Additionally, it includes lump-sum payments for over 2.5 million individuals to compensate for benefits missed in prior years, which could amount to several thousand dollars per recipient.

Qualified workers include police, firefighters, postal workers, public school teachers and other government employees. Those who qualify need not apply for these increases, which will happen automatically. The Social Security Administration is still reviewing how to implement the law, so there is no timeframe for these increases for the moment.

Between this and the recent 2.5 percent cost of living adjustment, many households are poised to receive a financial boost. Contact an Adams Brown Wealth Consultant to adjust your retirement strategy due to the pending change in Social Security income.

Source: USA Today, Jan. 6, 2025